Liberalism

Anatomy of an idea

Barack Obama shuns the L-word. But his speeches brim with liberal ideas and ideals. What is it about the doctrine that dare not speak its name?

AUTHORS who defend liberalism must often struggle just to get the word out without facing incomprehension or abuse—even today. To the left, particularly in Europe, liberalism means the free-market dogma of clever simpletons who created the present financial mess. The American right’s complaint is quite different. Forget that Hamilton, Jefferson and Madison fathered liberalism in the United States. For nigh on 30 years conservative Republicans persuaded American voters that liberals were godless, amoral, tax-happy hypocrites.

Intellectually, little of either charge makes sense. Twinned with “democracy”, as in what the West stood up for during the cold war, “liberal” was a term of pride. Since communism failed, the case for liberal democracy has only strengthened. Think of outstanding alternatives: illiberal Russia, undemocratic China, populist Venezuela, theocratic Iran.

Odder still, put this question to people who live, or would like to live, in a liberal democracy: “Which of the following values do you espouse—personal freedom, rule of law, active but accountable government, free but responsible markets, mutual toleration and equal concern for all?” It is a fair bet that people will tick most or all items on this list. Ask them if they are liberals, on the other hand, and many will turn contemptuously away.

That 20th-century connoisseur of doublespeak, George Orwell, would not have been surprised. Political language, it seems, has taken leave of political facts. Alan Wolfe, a professor of politics at Boston College, thinks it time to reunite them. His welcome and readable essay lays out what he thinks liberalism really amounts to and why it demands support.

Liberal politics, on his account, is rooted in a view of what matters in a human life. A gifted guide, he opens with a brisk Grand Tour of the liberal tradition. Glimpses of leading thinkers and the human values they argued for include Immanuel Kant (moral and intellectual autonomy), Benjamin Constant (protection from arbitrary power) and John Stuart Mill (promotion of human individuality).

The link with politics is that those three values all involve freedom. Whatever else it is, liberalism is about nourishing human liberty. Where liberals disagree is how that fits with a second powerful ideal, equality.

Right-wing liberals contrast “classical”, small-government liberalism and the modern, active-government kind. The one, so they claim, leaves people free while the other wrongly infringes freedom on behalf of equality. That story became popular in the 1970s, both as a history of liberalism and as a view of government’s limits.

Mr Wolfe, like other left-wing liberals, finds the contrast historically inept and conceptually confused. Making enemies of freedom and equality ignores, in his view, the democratic presumption that any one person’s liberty matters as much as the next person’s. It is deaf also to the fact that modern citizens’ freedoms are often limited by big social forces beyond their control. If all citizens are to be free in any effective sense, they require help from countervailing forces. Government is one such force.

If, the argument goes on, you take concern for everyone’s liberty seriously, you will treat the proper scale of government as a matter of circumstance, not principle. At times, government is overweening and ought to be cut back. At others, active government is required to steady markets, help the needy or serve the public good. Put abstractly, government may be called on to foster or restore equal liberty. Pragmatic, socially minded liberalism of that kind underpinned American and British government, from the New Deal until Ronald Reagan, from Clement Attlee to Margaret Thatcher. It seems, from necessity, to be with us again.

Mr Wolfe touches many topics. He defends liberals against the charge that they seek, illiberally, to keep religion and morals out of public life. In his most policy-minded section, he traces how liberal commitment to openness plays out with regard to free speech, immigration and transparent government. He notes the illiberal undertow of what he nicely calls “self-incapacitation books”, or popular-science writing in behavioural economics and evolutionary psychology claiming to show what little part reason and responsibility play in how we behave. He rebuffs the frequent charge that liberals are wobblers or dreamers. The true liberal temper, he tells us, is realistic, ironic and disabused.

Through no fault of Mr Wolfe’s, this fine defence of liberal values risks seeming to lag behind the news. He completed his book before Wall Street imploded, the American economy slumped and Barack Obama won the White House. Whether or not they buy the reasoning behind it, many readers will think Mr Wolfe’s call for active government is now merely pushing at an open door.

Faster than anyone expected, the argument among liberals has shifted. It is no more about active versus limited government, but about what active government should be doing. On that Mr Wolfe could have said more. No one with an open mind, however, can come away from “The Future of Liberalism” treating “liberal” as a term of abuse. Before long, who knows, even Mr Obama may drop his reserve and embrace the word with pride.

Zippy Livni; nearly Netanyahu

Israel's election

Zippy Livni; nearly Netanyahu

Voters in Israel give Kadima a surprise boost, but haggling over the next government must now begin

KADIMA, the centrist party led by Tzipi Livni, appears to have won the first battle of the Israeli election, over Likud, led by Binyamin Netanyahu. Projected results on Wednesday February 11th, with soldiers’ votes still to be counted, showed that Kadima would claim 28 seats in the 120-seat Knesset, just pipping Mr Netanyahu’s Likud with 27. The final result will not be known for some days.

But Mr Netanyahu may yet win the political war, as he has a strong claim to the prime ministership. A long and tortuous process of coalition haggling is now set to begin. Ms Livni, despite her party’s surprisingly strong showing, will find it hard to form a government, as the leftist block managed to pull together just 54 or 55 seats. The Labour Party, in particular, scored badly, crashing from 19 to 13 seats.

It will not be easy for Mr Netanyahu either, despite the right-leaning block, led by Likud, gathering 65-66 seats. The rightists are divided among themselves over domestic issues and Mr Netanyahu, in any case, does not want a government comprising only rightists, preferring a more moderate-looking coalition. Some of the religious parties could conceivable team up with Ms Livni. And Avidgor Lieberman of the far-right Yisrael Beitenu (Israel Our Home) who was the elections' biggest gainer, winning 15 or 16 seats, up from 11 last time, has previously teamed up with Kadima and could just possibly do so again.

Mr Netanyahu would have preferred to bring in Labour, under the present defence minister, Ehud Barak, but that party’s poor showing will mean he would be hard put to offer Mr Barak the defence portfolio again. And many key Labourites insist their party must now go into opposition, to try and rebuild its shrunken constituency.

Instead, if Mr Netanyahu is able to consolidate his rightist block, he will presumably turn to Kadima and try, by persuasion and blandishments, to convince Ms Livni to set aside her dreams of becoming prime minister and join with him instead in a broad-based centre-right government. He will cite the looming threat of Iranian nuclear ambitions, and the more immediate challenges of Hamas and Hizbullah, plus the economic slump, as reasons enough for Kadima to put aside its reservations and share in the responsibility of government.

To sweeten the package, Mr Netanyahu might offer Kadima two tempting jobs: the foreign ministry for Ms Livni and the defence ministry for her deputy, Shaul Mofaz. Mr Mofaz is a former chief of staff who served as minister of defence under Ariel Sharon in 2003-05.

Both Mr Netanyahu and Ms Livni held televised victory ceremonies on Tuesday night, replete with piped music and much hugging and handshakes. Each assured cheering loyalists that he (or she) would be the one to lead the new government. Mr Netanyahu said the victory of the “national camp” had been unequivocal. Ms Livni claimed that talk of camps was anachronistic. She argued that the important contest had been “Tzipi or Bibi”—and “the voter” had chosen her over him.

Despite the leaders’ exhortations, there seemed something hollow in the orchestrated gaiety at both headquarters. Behind their determined smiles, Kadima members knew the arithmetic was against them. The Likudniks too, off-camera, admitted that coming in second was a serious blow to Mr Netanyahu’s prestige.

The person with most to smile about was Yisrael Beitenu's Mr Lieberman, who held his victory celebration earlier in Jerusalem. There the rejoicing was authentic for, as Mr Lieberman noted, the party’s tally had shot up. That, he said, meant that “the key is in our hands”.

He said his heart was “with the right”, but the choice would be “not simple at all”. He wanted an uncompromising stand against Hamas, he said. “The first priority is to eliminate Hamas.” But Mr Lieberman, like Ms Livni and Kadima, also accepts the notion of two states, one for Israel, one for Palestine.He repeated, too, his campaign demand for a test of loyalty for all citizens of Israel, including Arab ones. He has demanded that Orthodox Jews as well as Arabs be required to do national service. He wants to break the Orthodox stranglehold over marriage laws. He also advocates radical reform of the electoral system. None of this civil agenda endears him to the religious parties that are Mr Netanyahu’s natural allies in the “national camp”. Mr Lieberman recalled that Shas, the largest Orthodox party with 11 seats, had cursed him during the campaign. “There’s a morning after…there are things we won’t forget,” he warned.

Hence the prospect of long and difficult bargaining to come. The process will begin formally once the results are published officially. President Shimon Peres must consult with all the 12 parties that have crossed the 2% threshold and made it into the new Knesset, and then decide whom to invest with the mandate to form a government. The candidate has up to six weeks to get the job done.

Washington’s Future Billionaires Need Salary Cap: Kevin Hassett

Commentary by Kevin Hassett

Feb. 9 (Bloomberg) -- It was the height of irony. Before the dust had even settled on the grave of Tom Daschle’s nomination, President Barack Obama imposed a $500,000 cap on the salaries of executives who work for firms receiving “extraordinary assistance” from the Troubled Asset Relief Program.

A half-million dollars is hardly enough to pay Daschle’s car-and-driver bill.

Obama’s restriction follows a theme he has been pounding since the election: Greed got us into this mess. “You’ve got corporate executives who are giving themselves million-dollar golden parachutes and leaving workers high and dry,” he said during the campaign. “That’s wrong. It’s an outrage.”

Maybe so, but isn’t it time that we expose politicians to the same scrutiny we are applying to the private sector? If Obama really wants to make the country a better place with a $500,000 salary limit, he should cap the salary that government officials can earn after they leave government service.

To make sure the rule has teeth, the salary limit should be in effect for at least a decade after somebody leaves the government.

Such a sentiment might seem an outrage, but it used to be widely accepted. In his memoir, Harry Truman wrote: “I could never lend myself to any transaction, however respectable, that would commercialize on the prestige and dignity of the office of the presidency.” After leaving the presidency in 1953, he lived on an army pension for $112.56 a month.

No Trumans Today

It’s hard to think of anyone in recent American political life who had Truman’s attitude. Why, even Ronald Reagan himself raked in more than $2 million for a set of speeches in Japan.

But the riches being raked in by today’s politicians put Reagan to shame. They can do so because government has gotten so big that a nod of Uncle Sam in your general direction can be worth billions. People who know how to get Uncle Sam’s attention are priceless.

We learned during Daschle’s confirmation hearings for secretary of the Health and Human Service Department, that his income exceeded $5 million in the two years after he left Congress. Who knows? That might be par for the course for a former senator.

Bill Clinton’s lucrative speaking engagements earned him almost $52 million in the first seven years after leaving office in 2001, according to CNN. At least he was giving an entertaining speech. There are far too many former politicians who exist in a kind of netherworld between the private sector and Washington, quietly raking in riches without performing actions that are visible to the public.

Rahm, Rubin

One could easily fill an encyclopedia with examples from both political parties.

Former Vice President Dick Cheney made millions at Halliburton Co. Current White House Chief of Staff Rahm Emanuel made more than $16 million working for Chicago-based investment bank Wasserstein Perella & Co. (then known as Dresdner Kleinwort Wasserstein) after leaving his post as senior adviser to President Clinton.

The most-famous recent case is Clinton’s former Treasury secretary, Robert Rubin, who made more than $126 million in cash and stock as director and senior counselor of Citigroup Inc., according to the New York Times.

The reward system is so widely accepted that it is practiced even in broad daylight.

In the heyday of Fannie Mae and Freddie Mac, it was commonplace for politicians to be rewarded with lucrative posts there. Franklin Raines, White House budget director in the Clinton administration, became the chief executive officer of Fannie Mae and made more than $91 million during his six-year tenure. Jamie Gorelick, a deputy attorney general in the Clinton administration, moved to Fannie Mae in 1998 and made more than $26 million as vice chairman until 2003.

As bad as the problem has been over the years, it is about to get much worse.

Unprecedented Intervention

Government has introduced itself into the private sector in an unprecedented fashion in the past six months. Government officials are going to make decisions every day that have enormous financial implications for private firms. The stakes have risen to a level we have never seen before.

To put it in perspective, the panel overseeing the bank- bailout program known as TARP last week reported that the U.S. Treasury Department has been shortchanged in its investments by about $78 billion. Treasury purchased assets worth $176 billion for $254 billion.

That $78 billion is a transfer from taxpayers to private individuals. There are probably going to be many more transfers like it in coming months.

Price of Friendship

So I ask you, what would it be worth to a firm to hire a close personal friend of the people administering those government funds? Might it be worth a few hundred million dollars to make sure that when Treasury is paying too much for things, it does so in a manner that favors you instead of someone else?

If there is one thing we have learned in this recent debacle, it is that bad things we can imagine have a nasty habit of happening. Letting Washington bureaucrats hand out billions of dollars is a recipe for disaster.

It is not uncommon for politicians in the former Soviet Union to miraculously become billionaires. If salaries of departing government workers are not capped, the same may end up being true here.

When Handing Out $800 Billion, Be Wary of Cheats: Ann Woolner

Commentary by Ann Woolner

Feb. 11 (Bloomberg) -- As Congress opens up the federal spigot to pour hundreds of billions of tax dollars into the withering economy, a thought intrudes.

Considering the astounding size of the economic stimulant, how much of it will stimulate crooks?

We know from Pentagon spending that the bigger and more urgent the government program, the more plentiful the opportunities for those who take more than they are due.

The Senate yesterday approved more than $500 billion in new spending which, along with tax cuts, amounts to an $838 billion stimulus package. Before the week ends, congressional negotiators hope to reconcile it with the $819 billion House version.

This huge new store will be minded by many, the bills say. Inspectors general all over the government get an influx of cash to cover more internal investigations, and a new accountability board will take shape.

The best guard against profligate spending is located deep inside the massive stimulus package. It’s a little, largely unnoticed provision that can put sleuths to work detecting waste, fraud and abuse throughout the country at a cost of precisely zero.

“It’s the only thing that’s going to cost nothing to the taxpayers and will pay out dividends throughout the history of the bill,” says Michael Kohn, general counsel for the National Whistleblowers Center in Washington.

Spotting Fraud

It turns out the most effective way to spot fraud is to reward whistleblowers for pointing it out and protect them from reprisal. Of the $1.3 billion retrieved from alleged government fraudsters during the last fiscal year, $1.1 billion began with whistleblower complaints, according to the Justice Department.

In the 18 years since Congress strengthened its main weapon against fraud, the false claims law, the government has retrieved $21 billion, attributing 78 percent of it to whistleblowers.

Last year’s big fish was Merck & Co., which handed over more than $650 million to federal and state agencies to resolve accusations leveled seven years earlier by H. Dean Steinke, a Merck regional sales manager in Michigan.

He accused the company of paying kickbacks to doctors and hospitals for prescribing its drugs and overcharging states and the federal government. Under federal law, he got a cut of the proceeds: $68 million.

Steinke left the company shortly after he sued it, long before the case finally ended. But for whistleblowers who want to keep their jobs, they need protection, especially if they work for the government.

No-Bid Contracts

Whether it is complaining about billion-dollar no-bid contracts connected to the war in Iraq, reporting glossed-over aircraft safety problems to the Federal Aviation Administration or pointing out that air marshals can’t keep their cover and still follow the rules, insiders have been demoted, humiliated and sometimes fired for speaking out.

The appeals system for them is almost worthless, so pro- government is the special court handling them. When whistleblowers claim retaliation, the court has backed them 1 percent of the time.

Last year whistleblower advocates won approval in both houses of Congress to extend more protection, in part by letting them appeal in different federal courts. But the last Congress ended without reconciling the two bills, so advocates are pressing for it to become part of the stimulus package.

The House stimulus bill carries a provision making those improvements permanent for all whistleblower complaints.

‘Landmark Amendment’

“It’s a landmark amendment to overhaul protections for federal employees,” says Adam Miles, legislative representative for the Government Accountability Project, a whistleblower advocacy group unconnected to the National Whistleblowers Center.

Both versions of the congressional bill contain new protections for state and local government workers, as well as for company insiders. Still, the protections are “a primitive, almost dinosaur version of whistleblower rights,” according to Tom Devine, legal director for the Government Accountability Project. The bills say nothing about such basic matters as burden of proof, for example.

And in letting state and local government workers appeal to federal courts if inspectors general find their whistle blowing frivolous, the bills don’t yet speak to the critical matter of whether state actions are immune from federal oversight.

“Unless they do, it will be false advertising to claim state and local government whistleblowers will be protected” Devine says.

Serious Senate Work

“There’s been real serious work in the Senate to clean up the language,” he says, which he expects to see in the reconciled version.

President Barack Obama and Treasury Secretary Tim Geithner are warning that some aspects of the stimulus package probably won’t work exactly as expected.

But once Congress sharpens the new whistleblower protections, a few billion dollars wasted here or stolen there just might wind up back in the treasury.

King Says U.K. in Deep Recession, Pledges More Easing (Update4)

Feb. 11 (Bloomberg) -- Bank of England Governor Mervyn King said the U.K. is in a “deep recession” that may force policy makers to create money and pump it into the economy after cutting interest rates to a record low.

“Further easing in monetary policy may well be required,” said King at a press conference in London after presenting the central bank’s revised quarterly forecasts today. “That is likely to include actions aimed at increasing the supply of money in order to stimulate nominal spending.”

Bonds jumped after the remarks, which mark a shift in focus to unconventional measures after the deepest rate cuts in the central bank’s history failed to stave off a recession that may be the worst since World War II. The yield on the two-year government bond fell 25 basis points to 1.36 percent.

“We now expect the Monetary Policy Committee to cut rates to zero at the March meeting and introduce quantitative easing,” said Michael Saunders, chief Western European economist at Citigroup Inc. in London. That will probably include “purchases of a range of assets, including gilts but also private sector assets.”

The Bank of England’s Monetary Policy Committee, which cut its benchmark interest rate to 1 percent this month, next meets to decide on rates on March 5. King, 60, said that policy makers can start using new tools before rates fall to zero because “we’re getting to the point where the efficiency of further cuts is diminished.”

King ‘Defeatist’

“It was a very defeatist press conference,” said David Tinsley, an economist at National Australia Bank on London and a former central bank official. “The fire has gone out of him a bit. There’s not much left in the kitty.”

King interrupted reporters and reprimanded some for not listening to what he had said in previous statements. He refused to apologize for failing to foresee the crisis, saying “I’m not paid to forecast the future.”

Prime Minister Gordon Brown has already given King authority to buy securities using government money and King today indicated officials may go beyond the existing plan.

Under quantitative easing, the bank would create money and use it to buy securities such as government and corporate bonds. That would boost liquidity in credit markets and increase the supply of money flowing through the economy.

“If we were to go to the wider operation, the MPC could decide that it wished to conduct such operations financed by the creation of central bank money,” said King today.

‘Shock and Awe’

The governor, reappointed for a second five-year term by Brown last year, is responding to criticism that the Bank of England hasn’t acted fast enough to the crisis. Former policy maker Sushil Wadhwani said yesterday the central bank should adopt “shock and awe” tactics. Fathom Financial Consulting, a firm founded by a group of former central bank economists, yesterday urged the government to buy houses as a means to increase the money supply.

“We need quantitative easing, we need credit easing and we probably need a bit more fiscal stimulus,” said Wadhwani in an interview yesterday.

The deteriorating economy is eroding Brown’s popularity, which fell to a six-month low in a poll published in yesterday’s Times newspaper. The Bank of England forecasts show the economy will contract at an annual 4 percent rate by the end of the first quarter. Unemployment rose to the highest since 1999 in January.

Brown’s Support

Support for Brown fell five points in the last month to 28 percent, while the Conservative opposition retained the backing of 42 percent of voters, a survey by Populus Ltd. showed.

The Bank of England said today it’s concerned about a “more prolonged period of weak credit availability” if actions taken to stabilize the global banking system don’t prove wholly successful. That’s “a significant downside risk,” the bank said.

Inflation will slow to 0.5 percent at the end of 2010, said the bank, which has a target of 2 percent.

“Given its remit to keep inflation on track to meet the 2 percent target in the medium term, the projections published by the committee today imply that further easing in monetary policy may well be required,” said King.

Central banks are pushing rates towards zero across the globe, forcing them to use new tools to rescue their economies. Sweden’s central bank lowered the benchmark rate by a percentage point to 1 percent, twice as much as expected, and rates in the U.S. and Japan are already close to zero.

BOE Forecasts

The Bank of England forecasts are based on market expectations of the benchmark rate falling from the current 1 percent to 0.7 percent in the third quarter. The bank publishes its quarterly predictions in the form of fan charts without specifying exact numbers. It will release data indicating exact figures next week.

Britain faces the worst recession among Group of Seven nations, the International Monetary Fund forecasts. World growth will slow to 0.5 percent this year, the least since the end of World War II, the IMF said.

The U.K.’s inflation rate fell the most since at least 1997 in December. Consumer prices rose an annual 3.1 percent, compared with 4.1 percent the previous month.

Democrats Face Calls for Cuts in Talks on Final Stimulus Bill

Feb. 11 (Bloomberg) -- Democrats trying to send President Barack Obama a compromise stimulus plan within the next few days face demands for more spending cuts from lawmakers critical to pushing the bill through Congress.

At least three senators who supported the measure want cuts producing a package that would cost less than the $838 billion bill the Senate passed yesterday or the $819 billion legislation approved by the House last month.

The demands may prove pivotal because the Senate plan cleared a 60-vote procedural threshold this week by a single vote. Democrats say they expect a compromise plan would also need 60 votes.

The compromise proposal “has to be under $800 billion,” said Senator Ben Nelson, a Nebraska Democrat. “It’s not just me who believes that; there are some Democrats who believe that and our colleagues from the Republican side as well.”

He said he voted for the $838 billion package only to get it off the Senate floor and into negotiations with the House.

A spokeswoman for Senator Susan Collins, one of three Republicans who supported the stimulus bill in the chamber, said the Maine lawmaker agrees with Nelson. Another Republican backing the Senate bill, Pennsylvania’s Arlen Specter, said on MSNBC that he wants the compromise plan to total less than $800 billion.

Delay Possible

The call for a lower price tag may delay getting stimulus legislation to Obama. House Majority Leader Steny Hoyer, a Maryland Democrat, said congressional negotiators may not be able to come to an agreement by the end of the week.

“I don’t know what Steny’s talking about,” said Senate Majority Leader Harry Reid, a Nevada Democrat. Reid also said he and House Speaker Nancy Pelosi met yesterday with Obama to discuss a compromise. White House Chief of Staff Rahm Emanuel and Budget Director Peter Orszag met behind closed doors with Democrats about a plan.

Reid said lawmakers wouldn’t leave for their scheduled recess next week without completing work on the bill. “We need to get this done as fast as we can,” said Reid.

The competing House and Senate measures differ on several provisions, including the parameters of the income group targeted for a payroll tax cut, whether to provide sizable tax cuts to the housing and auto industries, how much aid to provide state governments and how much to spend building schools.

Dispute Over Cuts

A group of more than a dozen senators that included Nelson, Collins and Specter forced Democratic leaders to strip more than $100 billion from a previous draft of the bill before allowing it to come to a vote. Pelosi said last week she opposed many of the cuts agreed to in the Senate and would seek to have them restored.

Nelson countered yesterday that “material changes to the bill threaten its passage when it comes back” to the Senate after the compromise talks. Asked about the opposition among House Democrats to the Senate’s spending cuts, Nelson said, “If they can come over here and find three other Republicans” to vote for the legislation, then “they can probably put anything in it they like.”

Pelosi indicated yesterday the stimulus plan may end up smaller than what either chamber approved. “Usually you go to conference and split the difference between the two houses,” she said. “That may not be case here.”

Car Buyers’ Break

One of the casualties in the compromise talks may be an $11 billion amendment approved by the Senate last week that would temporarily allow new car buyers to write off from their income taxes the interest on their loans and the local sales taxes on their purchase. Senator Barbara Mikulski, a Maryland Democrat who sponsored the amendment, said yesterday she is concerned the proposal may be deleted from the final bill.

“The problem now is not the idea, but it is the politics,” Mikulski said on the Senate floor. “Let’s get the White House on our side. Let’s get the House of Representatives on this side. Flood not the streets, but flood them with phone calls.”

House Ways and Means Committee Chairman Charles Rangel, a New York Democrat, questioned the proposal. He said “all of that seems pretty bizarre to me” and “very expensive.”

Obama, 47, has used high-profile appearances this week to prod lawmakers to quickly complete their work on a stimulus bill. He continued that effort yesterday during a campaign-style stop in Fort Myers, Florida.

“Creating jobs and turning this economy around is a mission that transcends party,” Obama said at a town-hall meeting. “When the town is burning, you don’t check party labels. Everybody needs to grab a hose.”

Senate Minority Leader Mitch McConnell, a Kentucky Republican, attacked the stimulus plan as fundamentally flawed, saying he doubted it would do much to boost the economy.

“We’re taking an enormous risk, an enormous risk, with other people’s money,” McConnell said before yesterday’s passage of the Senate bill. “The president was right to call for a stimulus, but this bill misses the mark. It’s full of waste, we have no assurance it will create jobs or revive the economy. The only thing we know for sure is that it increases our debt.”

U.S. Trade Deficit Narrowed to Lowest Since 2003 (Update1)

Feb. 11 (Bloomberg) -- The U.S. trade deficit narrowed less than anticipated in December to the smallest in almost six years as the recession pushed oil prices and consumer spending lower, reducing imports.

The gap between imports and exports shrank 4 percent to $39.9 billion, the lowest since February 2003, from a revised $41.6 billion deficit in November that was wider than previously estimated, the Commerce Department said today in Washington. Imports fell to the lowest since 2005.

Mounting job losses, a lack of credit and a global downturn signal that imports and exports, both of which fell in December for the fifth straight month, will slide further. Some U.S. firms are lobbying for a “Buy American” provision in President Barack Obama’s stimulus plan, while nations such as France and Russia are taking steps to protect local jobs and production.

“The boost from trade has vanished,” Jonathan Basile, an economist at Credit Suisse Holdings in New York, said before the report. “U.S. demand is falling even faster than demand from our trading partners. There’s weakness across-the-board in imports, and the global recession will be a damper on exports.”

The trade gap was estimated to narrow to $35.7 billion, from an initially reported $40.4 billion in November, according to the median forecast in a Bloomberg News survey of 70 economists. Deficit projections ranged from $31 billion to $45 billion.

Deficit Narrowed

For all of 2008, the U.S. trade deficit narrowed to $677.1 billion from $700.3 billion in the previous year.

Treasuries were little changed, with longer-term securities ending a two-day rally, before a record $21 billion auction of 10-year government notes. The 10-year note yield rose 2 basis points, or 0.02 percentage point, to 2.82 percent at 8:36 a.m. in New York, according to BGCantor Market Data.

Imports in December dropped 5.5 percent to $173.7 billion, the lowest since September 2005, from $183.9 billion the prior month as U.S. consumers bought fewer foreign-made cars and trucks and oil prices fell. Purchases of clothing, furniture and household appliances from outside the U.S. also declined, further reflecting shrinking demand for foreign-made goods.

The average price of imported oil fell to $49.93 a barrel, the lowest since December 2005, from $66.72 in November, the report said.

Exports in December fell 6 percent to $133.8 billion. Sales abroad of U.S.-made automobiles, parts and engines fell to the lowest level since November 2004.

After eliminating the influence of prices, which are the numbers used to calculate gross domestic product, the trade deficit widened to $43.3 billion from $40.1 billion.

China Trade

The trade gap with China narrowed to $19.9 billion, while the trade deficit with Canada shrank to $2.8 billion.

Imports from the European Union increased, causing the trade gap with the bloc to widen to $7 billion.

U.S. gross domestic product is forecast to contract again this quarter after shrinking at a 3.8 percent annual pace from October to December, the most since 1982, as consumer spending, about 70 percent of the economy, plunged.

Trade, which has added to the U.S. economy since the first three months of 2007, will be less of a help in coming quarters, economists predict.

PPG Industries Inc., the world’s second-biggest paint maker, said last month that it may cut as many as 4,500 jobs because of weak global demand from automakers and homebuilders.

“The regions outside of North America, which had been really helping PPG in the first three quarters of last year, have sort of caught the disease that started here in the U.S. with the credit crisis,” Chief Executive Officer Charles E. Bunch said Jan. 27 in an interview.

Seeking Mandate

Steel companies including U.S. Steel Corp. and Nucor Corp. are pushing for a mandate that projects included in Obama’s stimulus plan use American-made iron, steel and other manufactured goods to build roads, bridges and tunnels.

Opponents of the provision, such as Caterpillar Inc., Microsoft Corp. and the U.S. Chamber of Commerce, have said it might spur protectionist measures around the world.

Congressional leaders are crafting an approach that would give preference to U.S. products only as long as such a move doesn’t violate trade rules.

The White House has demanded that the provisions satisfy U.S. obligations under the World Trade Organization.

Russia raised import duties on cars and trucks this year to protect its slumping producers. French automakers PSA Peugeot Citroen and Renault SA will get government loans after promising to keep jobs and production in the country.

European Union finance ministers decried protectionism when they met this week in Brussels to discuss how to help banks take toxic assets off their books, rescue carmakers and bring the euro-region economy out of a recession.

The global economy will expand 0.5 percent in 2009, the weakest pace since World War II, according to a forecast from the International Monetary Fund.

Geithner Leaves Questions and Markets Make Him Pay (Update2)

Feb. 11 (Bloomberg) -- Treasury Secretary Timothy Geithner ducked the tough questions investors want answered as he rolled out a plan to repair the financial system -- and stock traders made him pay for it.

Driving investor doubts was Geithner’s failure to clearly address three issues at the heart of the crisis: Will banks saddled with toxic debt be forced to fail? How will illiquid assets be removed from bank balance sheets? And what will be done to arrest the decline in house prices that triggered the turmoil?

The risk is that the market reaction sabotages the plan before it gets under way, forcing Geithner to change his approach in response -- a position that his predecessor, Henry Paulson, frequently found himself in. That may mean the plan “may just end being an interim step,” said Kenneth Rogoff, a former chief economist at the International Monetary Fund who’s now a professor at Harvard.

“Tim Geithner did a great job in painting the broad strokes of the problem and laying out general principles, but it was a big disappointment not to have more details,” Rogoff said.

Rogoff also said Geithner missed an opportunity to send a stronger signal distinguishing his approach from Paulson’s: “ I would have liked to see President Obama standing behind the Treasury secretary, considering this speech, more than anything else, was supposed to lay out the policies signaling a decisive break from the past.”

Bank Stocks

The Standard & Poor’s 500 stock index tumbled 4.9 percent as investors dumped bank stocks on skepticism whether the plan will work. Bank of America Corp. plunged 19 percent and Citigroup Inc. dropped 15 percent. Futures on the S&P 500 added 0.4 percent as of 8:47 a.m. in New York today.

Geithner will testify today on his plan at a Senate Budget Committee starting at 10 a.m. Chief executive officers of eight of the biggest U.S. banks may also be asked about aspects of the administration’s strategy at a House Financial Services Committee hearing at the same time.

The program Geithner laid out has three main elements: Injecting fresh government capital into some of the country’s biggest financial institutions; establishing a public-private partnership to buy as much as $1 trillion of banks’ bad assets; and starting a credit facility of up to $1 trillion to promote lending to consumers and businesses.

‘Dangerous Dynamic’

U.S. banks have sustained $756 billion in credit losses since the crisis began and have warned of more to come. “The recession is putting greater pressure on banks,” Geithner, 47, said in unveiling the Obama administration’s plan in Washington. “This is a dangerous dynamic, and we need to arrest it.”

President Barack Obama, speaking at a Feb. 9 press conference, said it was critical that the government restore investor trust in the financial system. “We’ve got to restore confidence so that private capital goes back in,” he said.

The trouble is that investors abhor uncertainty and Geithner only seemed to add to that with a proposal short on specifics.

“He should have waited until he had his ducks in order,” said Ward McCarthy, of Stone & McCarthy Research in Skillman, New Jersey. “The lack of detail leaves too much room for confusion, misinterpretation and speculation.”

Anil Kashyap, a professor of economics and finance at the University of Chicago Booth School of Business, gave Geithner credit for getting regulators to agree to subject the country’s 18 to 20 largest banks to stress tests to determine whether they have enough capital to withstand an even worse economy.

Tests for Banks

Geithner said the tests would be used to determine which banks need more capital from the government. Left up in the air is whether the government will shut down banks that the tests show are all but insolvent, rather than putting more money into them.

That’s a step that experts such as Rogoff advocate. “You don’t want to try to keep zombie banks on life support,” he said.

Until it’s clear which, if any, of the big banks the government may take over, investors will be wary of putting any more money into the sector for fear of being wiped out.

That’s a problem for Geithner because he is counting on investors to provide the bulk of the financing for his program to lift toxic assets from banks’ balance sheets. The illiquid securities, mainly tied to mortgages, have made lenders loath to extend new credit.

Toxic-Asset Fund

The so-called Public-Private Investment Fund that will purchase the securities will have an initial capacity of $500 billion, including some $50 billion backing from the government, and could grow to $1 trillion.

The details of how the fund will work have yet to be decided and Treasury officials suggested it could take months to come up with a final program.

“We are exploring a range of different structures for this program, and will seek input from market participants and the public as we design it,” Geithner said.

Officials said the program will aim to provide potential buyers of the assets, including private equity firms, with longer-term financing that they say they need to carry out deals.

“There is a lot of capital that seems to be waiting on the sidelines to acquire the distressed assets,” said John Lyons, chief executive officer of Savills LLC, a real estate investment banking firm. “The issues are nobody knows what the value of that product is, and we still have the falling knife syndrome,” in which plunging prices make investors reluctant to jump into the market.

More Money Needed

Louis Crandall, chief economist at Jersey City, New Jersey- based Wrightson ICAP LLC, said that the Treasury may ultimately have to ask Congress for more money to finance the purchase of the bad assets. Both Geithner and Obama have left open that possibility.

Behind some of the uncertainty of what the mortgage-related assets are worth is the continued decline in house prices. Home prices in 20 U.S. cities were down 18.2 percent in November from a year earlier, the fastest drop on record, according to the S&P/Case-Shiller index.

The Obama administration has pledged to use at least $50 billion from the bank bailout fund help the housing market by preventing foreclosures. Geithner said the details of the plan will be announced in the next few weeks.

“It would have been helpful to have a little bit more detail on exactly how the package is going to take place, how homeowners can apply, and the impact on financial institutions,” Dino Kos, a former Fed official who is now managing director of Portales Partners in New York, said in an interview yesterday on Bloomberg Television.

Senate Banking Committee Chairman Christopher Dodd, a Connecticut Democrat, praised Geithner for not moving “too quickly without a lot of thought involved in what the implications would be.” Still, he said, “I take this as the first step in the process. We don’t have a lot of time, the window is closing and we’ve got to move.”

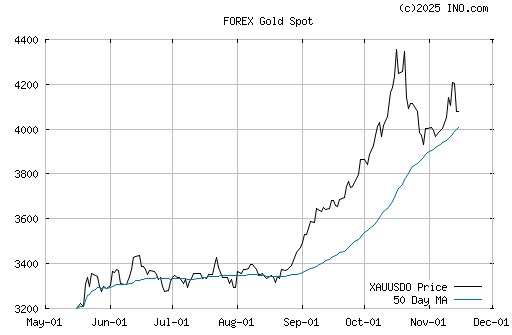

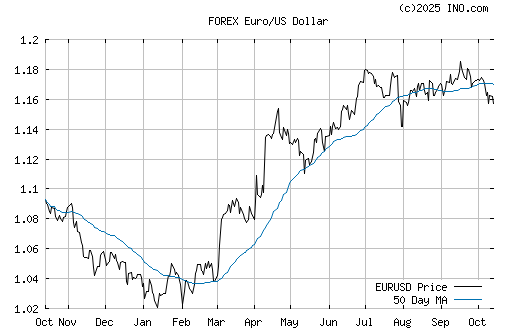

Markets and Data

Markets and Data

Current Prices | Monetary Trends | Interest Rates | Macrotrends | Federal Budget

Current Prices | Monetary Trends | Interest Rates | Macrotrends | Federal Budget

Current Prices | Monetary Trends | Interest Rates | Macrotrends | Federal Budget

Current Prices | Monetary Trends | Interest Rates | Macrotrends | Federal Budget

Current Prices | Monetary Trends | Interest Rates | Macrotrends | Federal Budget

Subway Hijinks

Subway Hijinks

One of the projects that President Obama's close to trillion dollar stimulus package is designed to pay for will be a much delayed subway line in New York City. The line has been authorized and paid for by taxpayers time and again through bond issues and federal aid over more than 60 years. Yet the line is years away because of cost overruns and various public sector problems.

Given the porkish nature of all these federal and state make-work programs, it is unlikely the subway line will be operating any time soon, yet riders are already being told of the marvels of public-sector projects.

Few things are funnier than reading Metropolitan Transportation Authority releases, the subway statements of pols or one of the delightfully devious "Heads Up" ads posted in subway cars. Recently, as I was delayed once again on the subway between stations one Saturday, I looked up and almost fell on the ground laughing as I read this gem from the MTA:

Starting in 2015, the new Second Avenue Subway will help relieve overcrowding on the Lexington Ave Lines. Overdue, but excellent news.

The MTA's leaders, along with their political enablers, obviously assume that the typical rider has no sense of history; that he or she has either forgotten or never learned the sordid history of countless broken promises by long-forgotten politicians. Reviewing their Second Avenue Subway promises, one thinks of the solemn and almost-always-broken treaties made with Native Americans, or what historian Helen Hunt called "The Shame of a Nation." The Second Avenue Subway could be called "The Shame of a City" — and of its political class across generations.

But our ruling Plunkitts and Tweeds know there's no need to worry. Indeed, as a former British cabinet member, Duff Cooper, once said, "Old men forget." We forget almost all of what has happened in the disastrous 67-year history of city and state authorities running our subways — and the federal government also kicking in big bucks. And that's a good thing for our rulers in New York and Washington. Otherwise we would remember that this infamous Second Avenue line was promised and repromised, as well as paid for several times over in the past 65 years or so!

Mayor Fiorello LaGuardia, who left City Hall in 1945, promised a Second Avenue Subway. He ran a "reform administration" that bought out the last privately managed lines. He ordered the Second and Third Avenue Els dismantled with the promise that a brand new underground Second Avenue line would replace them.

It never happened on his reform watch.

Yes, but the regulars, under Mayor William O'Dwyer, got back in power in 1946 after LaGuardia departed. O'Dwyer, in the Rancid Apple tradition of Mayor Jimmy Walker, later had to leave town owing to his legal problems. But in the 1950s, the regulars still persuaded the voters to pass a bond issue for a Second Avenue Subway. The voters once again believed their politicians — reform, regular, extra crispy, etc. — who regardless of party label usually run on a platform of promising the sun, moon, stars, and all the planets if only one gives them one's vote.

The bond issue, which added more debt, easily passed in 1951 — and guess what? The line was never built. The money was needed for other things because in the 1950s — as in the 1960s, '70s, '80s, '90s, 2000s, etc — the system was falling apart, but money was needed then and now just to close the persistent deficits that happen whenever the government runs anything.

Yet despite the best efforts of pols and mainstream journalists — who lectured people to use mass transit, while they themselves often used cars — bad things happened. Fewer and fewer people over the last 60 years rode the wretched subways. And why not? The public system has progressively become dirtier and slower. It is a hopeless place where one should be advised to wear ear protection.

So the government through its various authorities couldn't get people to ride subways. The subways ran bigger and bigger deficits, a frequent theme in just about any government-sponsored enterprise, as some are just learning with Freddie Mac and Fannie Mae.

However, authority enablers (who in the 1950s and '60s looked the other way as authorities started skimping on maintenance) kept insisting that it was ridiculous to ever expect the system to break even, no less turn a profit. This conveniently overlooked the fact that, in the first 20 years of the system from 1904 until the early 1920s under a private management company like the Interborough Rapid Transit System (IRT), the subway did make money. Indeed, it was considered "an engineering marvel," according to Robert Caro in his biography of Robert Moses, The Power Broker.

Later, of course, the IRT was happy to sell out. The backdoor socialism of price controls — the fare was never allowed to rise above a nickel until the government and then the fare went through the roof — destroyed the IRT just as rent controls slowly destroy many properties.

But back in the golden era of the subways under private management, people came from all over the world to admire our system. Try telling that to people who ride the system today on the weekends when there is no express service. Try telling that to passengers who are constantly delayed because the signaling system is ancient, dating back to the 1930s (even though reverse signaling has been the standard for a generation or more). But in the 1960s, the politicians continued on their merry way when the subject was the now mythical Second Avenue line.

In 1967, another bond issue was passed. Once again, the voters agreed to impose more debt on themselves and their scions with the promise of a new subway line. These decisions have helped to make New York State one of the highest debt states in the nation.

Mayor John Lindsay (1966–1973) knew all about running red ink and making promises that never came to fruition.

In the 1960s, Lindsay promised to expand the E and F lines from Jamaica to the Queens/Nassau border. That, of course, never happened, although the Archer Avenue extension in the 1980s tried to make riders forget that any such promise had ever been made.

Lindsay broke ground for the Second Avenue line in October 1972, or tried to do so. He had trouble with the jackhammer, which was an ominous sign. Nevertheless, someone helped him and, with a pack of vote-hungry public officials watching, the ground was broken for the Second Avenue line. Overburdened East Side riders expected a new line by the 1970s or surely by the early 1980s.

Then it happened again. You guessed it. The money disappeared, even though the voters had approved a second bond issue. Once again, there was no Second Avenue Subway. But politicians always have new elections on the horizon and schemes to make those elections turn out the way they want.

So, with the fervent hope that none of his constituents ever cared about subway history, Rockefeller Republican Governor George Pataki, in 2005, proposed a state transportation bond issue, which easily passed. Every Democrat in the state loved it. So did most Republicans, who, in an example of what Orwell called newspeak, represent themselves as fiscal conservatives.

The bond issue included the infamous East Side line. Yes, more debt for the highly taxed Big Apple, but now we would "only" have ten years to wait. That's all.

Sure, it's "overdue" (sic), but it's coming, according to the official MTA party line, as explained to long-suffering subway riders who look up while hearing PA announcements that either blast their hearing or are announced in a strange, static-filled, undecipherable language.

Still, before we all get carried away, let us remember history. Let us remember that the record of the MTA and of prior authorities finishing projects is about as good as the New York Mets' recent record in finishing seasons. Let us remember that the MTA has been promising reverse signaling for years, a development that is, even now, years in the offing, according to its own schedule. Let us remember the record of the WPA in restoring prosperity to America in the 1930s.

Finally, let us remember that there is a word that can never be discussed or even mentioned when we talk about the myriad flawed federal, state, and city transportation systems. I mention the word now sotto voce, because I fear for my life to even say it. It is a word so evil that no important pol in New York will ever utter it even in private.

That word is "privatization."

Tuesday, February 10, 2009

Why Markets Dissed the Geithner Plan

Why Markets Dissed the Geithner Plan

Here's how he should handle the banks.

ANDY KESSLER

One of the cool things about being Treasury Secretary is that you get your signature on dollar bills, giving them authority, defending their honor. Timothy Geithner's plan to save the struggling banking system probably does the opposite, throwing good money after bad to a banking system struggling under the weight of its own mistakes. The markets don't like it. The Dow dropped 382 points while bonds rallied as a port in a continuing storm.

Mr. Geithner announced a three-point plan yesterday to "clean up and strengthen the nation's banks," and made a vague declaration to use "the full resources of the government to help bring down mortgage payments and to help reduce mortgage interest rates." Unfortunately, those are conflicting plans. Hence the markets' skepticism.

The Treasury secretary seems stuck on keeping the banks we have in place. But we don't need zombie banks overstuffed with nonperforming loans -- ask the Japanese.

Mr. Geithner wants to "stress test" banks to see which are worth saving. The market already has. Despite over a trillion in assets, Citigroup is worth a meager $18 billion, Bank of America only $28 billion. The market has already figured out that the banks and their accountants haven't fessed up to bad loans and that their shareholders are toast.

Second, Mr. Geithner wants to use up to $1 trillion to back new car loans, home loans and student loans. That's noble, but incredibly market distorting. Who gets these loans? Will banks be forced to loan to those with bad credit? Who sets loan rates? Doesn't this just set up another credit squeeze when government guarantees are lifted?

What we need are healthy banks with clean balance sheets and enlightened risk assessment to provide consumer and business loans that will generate returns to shareholders. And to this end, Mr. Geithner wants to create a public-private partnership to buy toxic securities off bank balance sheets. This is a truly worthy goal, but I don't think his plan for doing so will work. Banks are more than able to sell these toxic loans today. They just don't like the price.

The first iteration of the Troubled Asset Relief Program (TARP) last year was to buy these bad loans and derivatives. It didn't work. Nothing was bought when it became clear that paying face value was a taxpayer giveaway to banks, but paying market prices for this stuff would cause huge equity write-downs, wiping out banks which would be left with negative equity and effective insolvency.

The next round of TARP injected money onto bank balance sheets first, boosting their equity so they could absorb the write-downs to come when the toxic junk was bought later. It didn't work. The $45 billion to Citi and Bank of America wasn't nearly enough. Instead, $306 billion and $118 billion loan guarantees were extended to cover the bad debt, which unfortunately, the market believes still weighs down banks' balance sheets.

Now with TARP 2.0, renamed a friendly Financial Stability Plan, the idea is to entice private capital to buy these bad loans and derivatives in an effort to set the "market price." But Mr. Geithner hasn't solved the dilemma of banks not wanting to sell and become insolvent. Moreover, no one is going to buy these securities ahead of Mr. Geithner's action with the "full resources of the government" to bring down mortgage payments and reduce mortgage interest rates. Lower mortgage payments means mortgage-backed securities would be worth even less. Six months to a year from now, big banks may still be weak and the ugly "n" word of nationalization will be back.

Mr. Geithner should instead use his "stress test" and nationalize the dead banks via the FDIC -- but only for a day or so.

First, strip out all the toxic assets and put them into a holding tank inside the Treasury. Then inject $300 billion in fresh equity for both Citi and Bank of America. Create 10 billion new shares of each of the companies to replace the old ones. The book value of each share could be $30. Very quickly, a new board of directors should be created and a new management team hired. Here's the tricky part: Who owns the shares? Politics will kill a nationalized bank. So spin them out immediately.

Some $6 trillion in income taxes were paid by individuals in 2006, 2007 and 2008. On a pro-forma basis, send out those 10 billion shares of each bank to taxpayers. They paid for the recapitalization.

Each taxpayer would get about $100 worth of stock for each $1,000 of taxes paid. Of course, each taxpayer has the ability to sell these shares on the open market, maybe at $40, maybe $20, maybe $80. It depends on management, their vision, how much additional capital they are willing to raise, the dividend they declare, etc. Meanwhile, the toxic assets sitting inside the Treasury will have residual value and the proceeds from their eventual sale, I believe, will more than offset the capital injected. That would benefit all citizens, not the managements and shareholders who blew up the banking system in the first place.

Mr. Kessler, a former hedge-fund manager, is the author of "How We Got Here" (Collins, 2005).

Geithner at the Improv

Geithner at the Improv

Amid more public uncertainty, private capital flees.

Judging by the hissing in financial markets, Treasury Secretary Timothy Geithner's opening act as Rescuer in Chief yesterday was a bomb. What everyone saw was Geithner at the Improv, a routine with a few good lines but a lot of material that needs more, well, practice.

Rather than focusing on banks alone or proposing a single bailout architecture, Mr. Geithner offered something for everyone with a financial problem, albeit with most of the details left to be filled in later. Investors naturally took this to mean that, much like former Secretary Hank Paulson, Mr. Geithner will be making things up as he goes along. If the goal was to reduce uncertainty, it didn't work. (By the way, the Senate also passed the "stimulus" yesterday; stocks fell nearly 5%.)

That said, Mr. Geithner's proposal is correct in its tacit acknowledgment that there is no grand, miracle cure. The problem of the capital hole in the financial system is too big to fill in any single way, or with public or private capital alone. The bad assets need to be worked off one by one, institution by institution, until balance sheets are cleaned up and normal lending can start again. It's three yards and a cloud of toxic securities.

On that score, Mr. Geithner said the feds will subject all major U.S. banks to what he called a "stress test" to assess their financial health. We had thought this is what the FDIC, the Federal Reserve and other regulators were supposed to be doing all along, but that's last year's failure. A fresh and thorough scrubdown should be useful in forcing banks to be realistic about their businesses, especially the value of their bad assets.

The feds can then sort the banks that have enough capital and are worth saving from those that are insolvent but don't want to admit it. The latter can be liquidated, their depositors protected by the FDIC and their assets sold immediately to a healthier institution or worked off and sold over time. In Mr. Geithner's calculation, the banks that survive will emerge with a clean bill of health that will make them eligible for more public capital, which in turn will help the banks attract more private capital as well.

We were glad to hear Mr. Geithner say in his speech yesterday that "We believe our policies must be designed to mobilize and leverage private capital, not to supplant or discourage private capital." But one problem is that Mr. Geithner's proposal puts a higher priority on adding more public capital first as a source of financial stability. More public capital also comes with the risk of more public interference or control, especially with Congress looking for heads. (See today's House Financial Services spectacle with Wall Street CEOs as the pinatas.) And especially as the share of public ownership rises, so does the larger risk of government nationalizing many of our largest banks. This is a deterrent to more private investment, to put it mildly.

We think there's a strong case for the feds moving more aggressively to resolve Citigroup, a three-time loser whose bad paper taxpayers have already guaranteed to the tune of some $300 billion. Regulators could force more aggressive asset sales by Citi, which should have to shrink until it is no longer too big to require a taxpayer rescue. Refusing to bail out Citi's bond and equity holders would also send a message that the government is not going to save every big bank that takes bad risks merely because it is big.

But in making such a move, the Geithner Treasury should be clear that it has no intention of larger public ownership and control throughout the financial system. The bulk of toxic mortgage assets are on the books of 60 or so of our largest banks, so there's a real danger that under Mr. Geithner's plan taxpayers could end up being substantial owners in most of them. The risk is that deposits would then flow to these "national champion" banks because of their perceived safety, to the detriment of smaller competitors and new private investment in the banking system.

It's also unclear what Mr. Geithner has in mind for his other innovation, a new "Public-Private Investment Fund." He explained the concept as a way for Treasury to leverage up to $500 billion, and eventually perhaps $1 trillion, in private capital to buy toxic assets from banks. This would seem to echo Mr. Paulson's original concept for TARP money, which ran afoul of the difficulty of fairly pricing those illiquid assets. But the Treasury offered no other details.

Mr. Geithner told us in an interview that he doesn't intend this to be a resolution agency for failed assets, and acknowledged that "we're trying to do something that hasn't been done before." So this devil is all in the details, especially if it becomes a back-door attempt to recapitalize banks by overpaying for bad paper. Mr. Geithner would be wise to put someone strong and independent in charge of this fund -- someone who can say no to Congress and has no ties to Citigroup, Robert Rubin or Wall Street.

Like President Obama's, Mr. Geithner's rhetoric tends too much toward doom and gloom for our tastes, or to help public confidence. Americans know this mess is going to take time to work out. But there is a great deal of private capital ready to take risks again if the Obama Treasury lays out transparent, consistent rules -- and if it makes clear that its goal is to restore at the earliest possible date a healthy, privately run banking system.

Shape of Things to Come?

April 1, 2013 – Unemployment is approaching 25 percent, inflation is close to 40 percent, major portions of the

Collapse of the American economy in 2013 began with several major policy mistakes by the Fed, the "Bush 43" administration, and Congress in the years from 2004-08, which were compounded with even greater policy mistakes by the Obama administration, Congress and the Fed from 2009 thereafter.

The Fed had created much of the housing and commodity bubble of 2004-08 by allowing excessive monetary growth. Both the Republican and Democratic Congresses had failed, despite many warnings, to reform Fannie Mae and Freddie Mac and the Community Reinvestment Act, which led to the subprime mortgage crisis.

Both the Bush administration and Congress engaged in excessive federal spending growth, culminating in the ill thought out and counterproductive bailout "TARP" scheme in late 2008. And finally, even though almost everyone knew Social Security and Medicare needed fundamental reform, Congress refused to seriously deal with it.

After promises of "change," the new Obama administration, the Democratic Congress and the Fed only made changes for the worse. Despite an extensive history and strong empirical evidence - some of it coming from Mr. Obama's own economists - going back to the Great Depression of the 1930s that spending stimulus programs did not work and that tax rebates and credits were ineffective (as contrasted with marginal rate cuts), Congress and the Obama administration, in early '09, embarked on a record high spending "stimulus" program, along with a tax credit and rebate program for low-income people, many of whom had not paid any income tax.

Before these programs went into effect, the economy began to slowly recover, in part, because of the big injection of money by the Fed in the previous months. However, unemployment continued to rise, and thus the Fed continued to keep interest rates at record lows.

At the same time, Congress passed "card check" to make it possible for unions to gain control without a secret ballot. Congress also passed measures to make it easier for trial lawyers to sue employers for alleged discrimination, which further discouraged employers from hiring new workers. Congress also enacted into law a national health-care scheme, which essentially socialized all medical care in the

As the 2010 election approached, the Obama administration, faced with not meeting its employment goals, decided to embark on a massive government employment program. This program further dampened the economy as government jobs (and in many cases totally unproductive jobs) were substituted for more productive jobs in the private sector. (Note: The private sector had to be drained of money to pay for the jobs in the public sector.)

Meanwhile, much of the rest of the world - particularly

Despite the rise in inflation, the Fed was being pressured by the administration and Congress to continue to keep interest rates low, and Fed Chairman Ben Bernanke was replaced by a partisan Democratic economist who was in favor of bigger government.

As the 2012 elections approached, the Democrats were in a panic because the

Congress also reinstated the so-called "fairness" doctrine, which shut down much of the conservative talk radio opposition. Finally, Congress made it clear - without explicitly saying so - to much of corporate America that if the companies and their executives gave campaign funds to the Republicans, the companies would be cut off from potential government contracts (Chicago-like "pay to play").

Despite the growing economic disaster, President Barack Obama narrowly won re-election in 2012, but by early 2013, the consequences of the open-ended federal checkbook, unrestrained money growth, and unleashed trial lawyers and environmentalists became apparent to all. Unemployment rose even more rapidly, and inflation rates began to make the

Americans found, as other countries had experienced, that national health insurance resulted in massive queuing and a steep drop in quality. Those who could still afford it, and had sufficient time, traveled to other countries (including the newly democratic and capitalist

Companies were leaving the

Fortunately, it is only January 2009, and none of the above needs to occur - if Mr. Obama listens to some of the better economists he has appointed. But if the Obama administration and the Democratic Congress let themselves be captured by their big government, high tax, environmentalist, union leader and trial lawyer allies, the above scenario is as certain as was the end of the subprime mortgage bubble

Have They No Shame? A Power Grab at the Census

Have They No Shame? A Power Grab at the Census

The White House is taking control of the census — and the GOP is sounding the alarm.

Amidst the high-profile fight over the stimulus plan and the embarrassing tumult over the batch of Obama administration appointees with tax cheating problems there hasn’t been much attention paid to the most naked power grab yet attempted by the Obama administration: the effort to wrest oversight of the federal census from professionals in the Commerce Department.

As required by the Constitution, every ten years the federal government undertakes a massive effort to count and gather information about Americans. The information impacts hundreds, if not thousands, of decisions about federal funding and policy. But most importantly, it will be the basis for the redistricting which determines Congressional representation.

The White House has proposed that the director of the Census, a Commerce Department employee, report to the White House. The White House contends this is no big deal. Nevertheless, the move followed a wave of protest from liberal civil rights groups concerned that they might not succeed in maximizing the count of minority voters if the census remained under the auspices of Republican Judd Gregg, the Commerce secretary nominee.

Republican leaders in Congress are waking up to the implications of the White House’s decision and beginning to sound the alarm. Two Republican congressmen have sent a letter to the White House protesting the move. The congressmen cited Title 13 of the U.S. Code, requiring that the Census Bureau be administered “within, and under the jurisdiction of, the Department of Commerce.” They contend that “the Executive Branch is limited to providing support for the Bureau in the form of information and resources.”

On Sunday Republicans fanned out on TV to try to raise public awareness of the issue. Minority Leader John Boehner on Fox News Sunday explained:

It just tells me that the census, the counting of the population of the United States is going to be politicized. This is very simple, Chris, the Constitution says that every ten years there will be a count of all persons who live in the United States. That means that we need to have an actual count. And why this has to be moved from the Commerce Department over to the chief of staff’s office, I would think he’d have better things to do, than to coordinate the census, but apparently they have ideas about what they might want to do to politicize the counting of our population next year.

Sen. John Cornyn echoed a similar sentiment during his exchange with Chris Wallace:

WALLACE: Senator Cornyn, we now learn that the Obama administration is going to have the director of the Census Bureau report not only to the commerce secretary but also to the White House. What’s wrong with that?

CORNYN: Well, ordinarily, this has been something that the commerce secretary has done, and I think it ought to be done on a competent, as much as possible, nonpartisan basis. And to shift it to the White House to me just politicizes the census, which is not something we should be doing.

WALLACE: And what’s the danger, briefly, of politicizing the census?

CORNYN: Well, because, of course, that determines who gets what congressional districts. States like Texas were going to get probably at least three new congressional districts based on the reapportionment — and then, of course, in drawing those lines, redistricting within states. It’s all based on those census figures. So if you cook the figures up front, I think it distorts that process going forward and undermines the concept of one person, one vote.

Mainstream news reporters also are beginning to discuss the implications of this move. Rick Klein wrote on The Note:

GOP lawmakers are pointing out that the new structure will effectively leave White House Chief of Staff Rahm Emanuel — a former chairman of the Democratic Congressional Campaign Committee — in a decision-making position regarding how Census business is conducted.

“The Census is supposed to be not only outside of politics, but transparent,” said Rep. Darrell Issa, R-Calif., the ranking Republican on the House Oversight and Government Reform Committee. “This implies that President Obama intends on getting a count to his liking. It borders on overt political corruption.”

While the program to count and compile data on Americans might not seems political, the reapportionment of House seats based on the decennial census has huge political ramifications. In addition, the census data will be used to determine funding formulas for a wide range of government programs.

It is ironic that the Obama team selected Republican Judd Gregg to head the Commerce Department as an intended symbol of the Obama administration’s commitment to New Politics. This was supposedly evidence of a less cravenly political style of governing than what many contended was par for the course in the Bush years. Now, it appears the Obama team intends to strip Gregg of real authority over this key responsibility, giving lie to the notion that the Obama administration believes in post-partisanship.

Had this stunt been attempted during the Bush years one certainly would have heard a hue and cry from good government groups, the media, and academics. We no doubt would have heard a chorus of opposition: “The professional public servants are being shunted aside!” And from those so aghast about attempts to suppress or manipulate voting, we would have expected the shrieks: “This is an attempt to politicize the census and stack the deck for reapportionment!” It is not hard to imagine the reaction if the Bush White House had suggested that a supposedly unbiased statistical undertaking should be directed by, say, Karl Rove.

It is unclear what, if any, recourse Republicans might have. If public pressure can be generated, the White House might retreat. (The White House already seems to be scrambling, trying to belatedly clarify that the Census Director will merely be working “closely” with the White House.) But it is far from certain that the public will see through the White House spin and rise up over something as arcane as control over the census.

Alternatively, Senate Republicans might seek to hold up Gregg’s confirmation until assurances are provided that the census will be not be controlled by political operatives in the White House. Combining disgruntled Republicans with liberal Democrats (who might be loathe to put a conservative Republican in the Obama cabinet) might raise the potential for a filibuster. Nevertheless, Republicans haven’t been successful in mounting serious challenges to nominees so far.

Concerned congressmen might seek to mount a legal challenge. However, the knotty issue of who possess legal “standing” to sue and other legal defenses may dissuade courts from weighing in. (Sources on Capitol Hill report that Republican counsel are mulling over the legal issue.)

It therefore remains to be seen whether the White House can be forced to give up the idea of seizing control of the census and instead to guarantee that it will remain free from political interference. If not, and this issue continues to fester, it will likely shed further doubt on Obama’s claim to be the harbinger of a new era in Washington. In the end, the White House is unlikely to retreat unless overcome by the fear that President Obama’s image — which has taken a beating in the first few weeks of his presidency — might be unduly imperiled. So, for now, Republicans are left to ask, “Have they no shame?”

The Pelosi Placebo, or how to anesthetize the economy for fun and profit

The Pelosi Placebo, or how to anesthetize the economy for fun and profit

The first thing we have to do is stop calling it a “stimulus package.”

In an earlier post, I described it in passing as the Pelosi Placebo–”Pelosi,” after the person primarily responsible for overseeing this “legislative abomination,” “Placebo,” “something lacking intrinsic remedial value and that is done or given to humor another.” In this case, “another” are congressional Democrats who have been straining at the bit for years to glom on to your money for this or that spending spree and have suddenly hit upon a new formula: “People don’t like it when we go massively into debt in order to act out our redistributionist spending fantasies, so let’s not call it the mother of all spending bills (which is what it really is) but, rather, a ’stimulus package.’ It will take ages for the suckers whose lives we run to notice that the only thing this trillion dollars stimulates is credulousness.”

As Karl Rove noted in The Wall Street Journal the other day, what Congress is preparing to shove down our throats is “a mammoth spending bill, not a stimulus or jobs package.”

It is not surprising that the stimulus package is laden with new spending programs. Congressional appropriators, not job creators, wrote H.R. 1. Much of it is spending Democrats couldn’t get approved in the normal course of affairs. And it should not shock Americans that Democratic appropriators would funnel tax dollars to the Association of Community Organizations for Reform Now, unions and other liberal special interests.

Rove is right, but he really should follow his own point and refrain from calling this piece of legislative larceny a “stimulus package.” It is not a stimulus package, except in the derivative sense that it can be counted upon to stimulate that appetite for ever more government spending.

It’s not a stimulus package. Then what is it? A fraud on the taxpayer? Yes. A massive transfer payment to various Democratic special interests? Yes. Another notch in the ratchet that is pushing the United States in the direction of top-down bureaucratic socialism à la Sweden? You betcha. Mark Steyn produced what is perhaps the most vivid analogy. You know that unemployed mother of six who, thanks to the miracle of modern medicine, just gave birth to another 8 babies? She’s been all over the news and has been the object of lots of finger waving. But why criticize her for irresponsibility when your government (forgive that anachronistic “your”) is doing the same thing, but on a much, much bigger scale. As Steyn explains,